Lucky Millennials got quality time, arguably too much of it, from their parents. Now mostly grown up and on their own, they’re getting out-sized attention from marketers. With Millennials outnumbering Baby Boomers and surging through their family and household-building years, it’s time to take a closer look at this diverse generation. After all, Millennials reflect America, and there are more than 10 million adult African-American Millennials among more than 73 million total adult Millennials.

Adult Millennials – those aged 18 to 34 in the latest American Community Survey – were born between 1980 and 1995, though definitions vary. They were the entire school-aged population from first grade through college as the events of 9/11 unfolded. If generations are seared and defined by history and trends during their formative years, surely Millennials qualify. For African-American Millennials there are sobering disparities but also untapped market potential. Data-driven marketers and market researchers need to fully understand market trends and opportunities not only among African American Millennials but among all the ethnic and cultural Millennial segments. If business stakeholders just let the numbers and voices speak, businesses and consumers can benefit. For example, consider these stats from the Census Bureau’s American Community Survey.

African-American adult Millennial buying power exceeds $162 billion as measured by annual personal income. Household buying power – where the householder is an adult African-American Millennial – is $115 billion. Among the 3.1 million households headed by African-American Millennials, mean income is $37,000 which is 65 percent of the overall average among adult Millennials – $57,000. Further, only 5.5 percent of African-American Millennial households have incomes of $100K or more, but that compares to only 14 percent of all Millennial households. Indeed, income disparities affect all Millennials regardless of ethnic origin and cultural background. Still, this is a youthful generation, and their true potential should grow as they take their families and careers into and through the higher-earning age groups. Conclusion: as with Baby Boomers during this life stage, now’s the time to establish and solidify some brand loyalty.

Fully 53 percent of today’s adult African-American Millennials attained at least some college experience after graduating from high school. Nearly 13 percent have bachelor’s degrees or higher educational credentials. Among all adult Millennials, 60 percent have at least some college-level experience, and 22.3 percent have a bachelor’s degree or more. Encouragingly, African-American Millennials currently attend undergraduate or post-graduate college programs to the same extent as all Millennials – 25 percent.

Eight in ten African-American Millennials are never-married singles, compared to 65 percent of Millennials overall. Clearly this statistic speaks to the many challenges faced by African Americans, especially men, during these formative years. Nevertheless, relationships and families of all ethnicities are often “in transition” during the young-adult years. Bottom line for marketers: singles and childless young couples predominate among all Millennials.

Where are the African-American Millennials? Location is always important, but not always what it seems. Increasingly, businesses rely on “location intelligence” as they sift through their desired markets, especially demographically defined markets like Millennials. Any strategy to address African-American Millennials needs to incorporate the geography of this important segment.

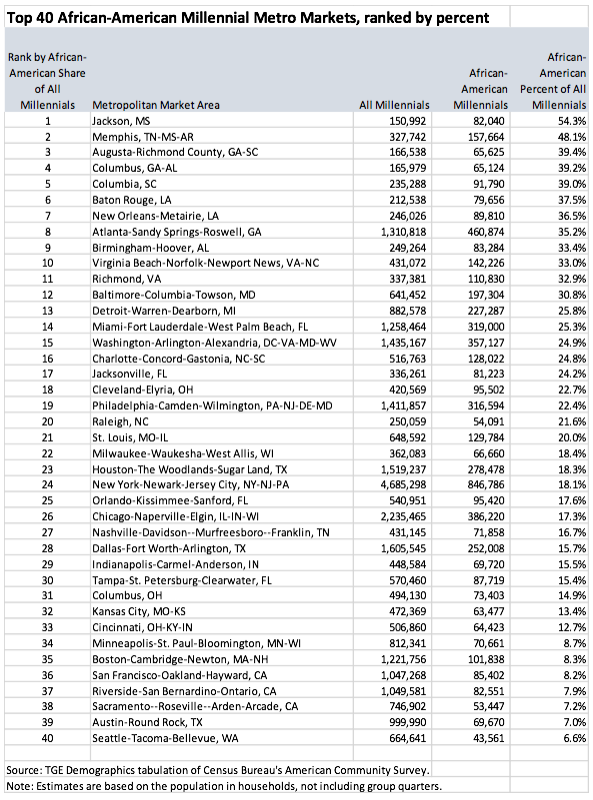

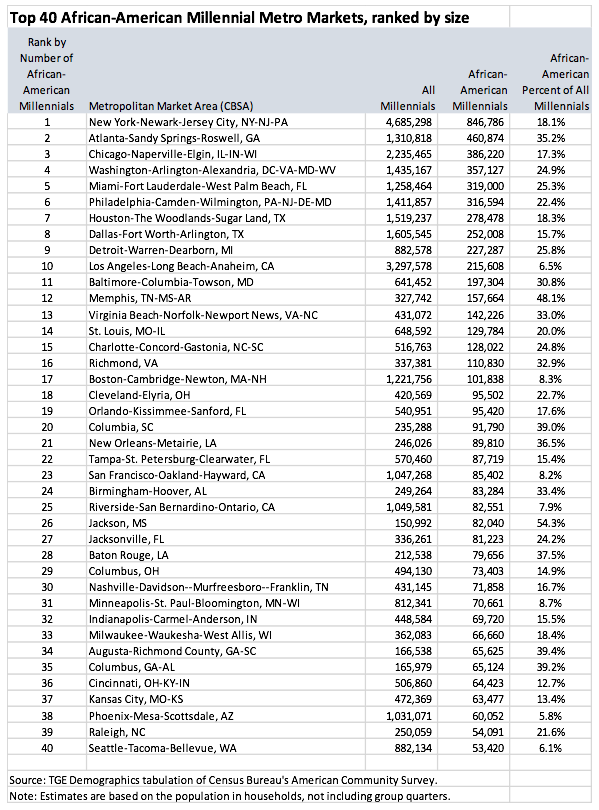

New York, Atlanta, Chicago, Washington, DC, and South Florida highlight the top five metro markets for African-American Millennials, measured by sheer size of the market. (See the Top 40 African-American Millennial markets in the tables that follow.) Clearly, metropolitan markets are easier to reach than non-metropolitan markets because of the concentration of all media, media specialization, and internet accessibility. Nevertheless, 6.7 million Millennials reside in non-metropolitan areas including 754,000 African-American Millennials.

African-American Millennials surpass 30 percent of the total Millennial market in 12 metros. Jackson, MS; Memphis, TN-MS-AR; Augusta-Richmond County, GA-SC; Columbus, GA-AL; and, Columbia, SC are the top five with respect to the African American share of all Millennials. In contrast, some of the largest metro markets – Houston, New York, Chicago, Dallas, Boston, San Francisco, and Riverside, for example – show less than 20 percent African-American Millennials. Nationally, including both metropolitan and non-metropolitan areas, African-American Millennials represent 13.7 percent of all Millennials. Such information can inform marketing and advertising campaigns that inevitably drive optimal returns on those same marketing and advertising campaigns.

Marketers with products and services targeted to African-American Millennials need to look at the geographic distribution and data-informed characteristics of this market – educated singles, couples with and without kids, youthful perspectives, and, yes, promising careers and entrepreneurial spirits – facts that break the stereotypes, the media portrayals, and the assumptions that do not represent the broader reality of these markets. Portraits, profiles, and percentages can reveal much about desirable market segments however defined. But up-to-date research, in-depth demographics, and savvy location intelligence of African-American and other Millennials can actually unlock new opportunities for many types of businesses. Astute market research – exemplified by Ebony Marketing Systems – is needed to explore and address consumer attitudes and behavior nuances, which are often influenced by location and local culture. Only then will intelligent, data-driven marketing campaigns reach their full potential.